Sunday, March 11, 2007

Monday, November 27, 2006

Simple explanation for privatizing Social Security

In the current American Social Security system, citizens are forced in to paying nearly 15% of their income (half from employer match) in to a system that is headed for failure. The success of Social Security depended on a high ratio of workers to retirees which hinged an increasing population that on average died before they ever received a penny of Social Security benefits. Social Security was only meant to supplement a person's retirement and not be the sole means of retirement. But Social Security is no longer solvent for the following reasons:

* People on average are living 10 to 20 years longer.

* Technological improvements that allow people to live longer also costs a lot more money.

* Population has not maintained its rate of growth so the work force isn't growing. If anything, it's dropping if we exclude gains from immigration.

Some ideas have been floated to save the Social Security system such as:

* Increase taxes

* Raise the retirement age

* Reduce benefits

The problem is that none of these solutions are popular nor should they be. Increasing taxes usually has the reverse effect of a slowed economy and an increased incentive for tax fraud which has a net effect of lowering tax revenues. Raising the retirement age is effectively reneging on the promise of retirement at 65 (62 if you're willing to take lower benefits). Reducing benefits would be disastrous at a time of increasing medical costs due to advances in technology and massive malpractice fraud. What we need is a solution that would decrease the tax burden, increase benefits, and reduce the retirement age. Snake oil you say? Read on and let me explain.

Let's take a person Bob and say he joins the work force at 22 years of age. Bob starts off making $20,000 a year. We create a mandatory retirement account where Bob is required to select from a list of Government approved no load index funds such as the S&P500 and Wilshire 5000 total market index fund or a combination of. Instead of putting 15% (7.5% of Bob's paycheck plus employer match) of Bob's income in to the Social Security system, it would go straight to Bob's retirement account. The account is in Bob's name but Bob isn't allowed to take money from that account nor can it be used for collateral on bank loans or be subject to creditors. Favoring a heavier composition of the S&P500 over the Wilshire 5000 index fund, we expect to get an ~11% annual rate of return in the long term. For example, the 1970 to 2005 average rate of return for S&P500 was 11.4%.

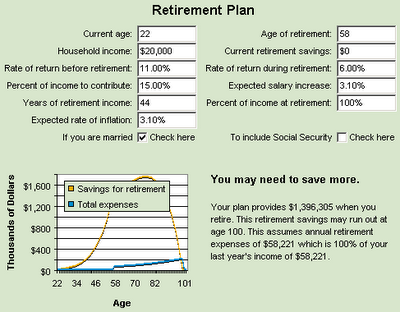

Bloomberg provides this retirement calculator which I used to produce the following numbers.

I assumed that Bob would only increase his salary at the same pace of inflation (set to 3.1%) which is fairly conservative since most people move up in life. Bob would only get a conservative 6% return on his money during retirement to minimize risk and volatility. In 2043 when Bob retires at 58 years of age, Bob would be earning more than $58K a year and would be able to maintain 100% income during retirement along with an annual increase equal to inflation. Under most retirement system, these kinds early retirement full benefits would be unheard of. Interestingly, the 36 years required for retirement works for any income level to achieve 100% retirement benefits that allow a retiree to maintain their life style during retirement. Here's an identical chart if college grad Bob was making $40K a year instead.

Bob would not be permitted to cash out his 1.4 million dollars when he retires so that he can't blow it all in a few wild nights in Vegas and become a burden on society. Bob would receive a check equal to his pay check for the rest of his life with annual adjustments for inflation. If Bob dies at 60 years old because of an early heart attack or an accident, Bob would be able to pass on his 1.4 million dollars to his loved ones or any charity of his choice. Compare this to the current Social Security system where if Bob died at 60 his loved ones would receive a big fat ZERO.

Bob should also have the option to enter a pool for the last 5 to 10 years of his retirement so that if Bob dies at 110, he would still be able to draw money from the pool until his death. But if Bob died at 90 years of age, any money left over would stay in the pool and not go to his family to cover people in the same pool who lived longer than expected.

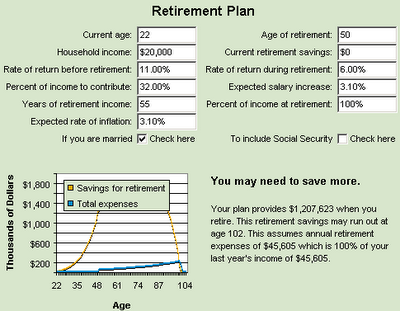

I ran some additional numbers where Bob decides to put in an additional 15% in to a 401K plan with 2% employer match and came up with the following numbers.

Interestingly, it wouldn't help Bob that much since it would only allow him to retire 8 years sooner at 50 years of age. It would seem that how long you invest is more important than how much you invest. It may still be a good idea to contribute at least 4% to maximize the employer match in typical 401K funds. If the employer matches half of the first 4%, you'll have 6% going in to your 401K on top of the 15% for the retirement fund. That puts 21% towards Bob's retirement which allows him to retire at 55. If Bob is willing to live with an 80% retirement fund (assuming his house is either mostly paid off or all paid off), then he can retire at age 50.

The bottom line is that we are all being robbed by the current Social Security system of a decent retirement. Instead of being able to retire at 58 and get 100% retirement benefits, we're asked to retire at 65 with pathetic benefits which may not even materialize at the current rate of Social Security's deterioration. The money we put in to the current system is spent by politicians as soon as the money is given to them and none of it is transferable to our loved ones.

[UPDATE 11/28 - My friend Justin commented that not everyone would be as aggressive to put most of their money in to the S&P500 and a 10% rate of return during the working years was a more conservative and less volatile number. While I would personally be fine with heavily favoring the S&P500, others may disagree and choose a more conservative route. Therefore I ran the numbers again with a 10% rate of return and it turns out that you could still retire at 60 with the same 100% full benefits which is infinitely better than Social Security.]

There are those who want to say that the stock market is too much of a gamble for a retirement system. Something like the S&P500 and Wilshire 5000 aren't gambles and have a proven history of solid performance in any long period of time. If the Wilshire 5000 total market index fund in America actually tanked, that would be dooms day for the United States and we can kiss all tax revenues good bye anyways so it would be a no lose situation for any retirement system. A mandatory index fund based retirement system in the US would actually act as a stabilizing force since every working person in the country would be invested in the fund and wouldn't be able to sell on a panic.

Every financially smart person is already using this kind of investment planning for their future in spite of the current broken Social Security system. Every smart investor understands the stability of index funds and the concept of compounding interests. If the upper middle class consider this sound financial planning for their own portfolios, why wouldn't it be good enough for everyone? The poor would most benefit from this system and be allowed to own a piece of America, share in its prosperity, have a decent retirement, and actually have something they could leave their children.

Friday, March 17, 2006

http://blogs.techrepublic.com.com/Ou